Liability Insurance Australia In Australia, Business Owners Have A Duty Of Care To Take Reasonable Steps For The Safety Of Any Third Party That Comes In Contact With Their Business.

Liability Insurance Australia. What Is Public Liability Insurance*?

SELAMAT MEMBACA!

Get your business insurance cover in one place.

Public liability insurance is necessary in australia for sole traders and small business owners to cover customer injuries, customer property damage, and other third party damages.

Public liability insurance is designed for professionals who interact with customers or members of with australia having been coined the second most litigious society in the world after the us, the.

General liability insurance, also known as public and product liability insurance, helps to protect your business in the event a claim for compensation is brought against you for injury or damage.

In australia, there is strict liability for damages caused by defective products.

This means that a person.

Compare 237 products offered for public liability insurance from 81 companies including ironshore australia pty ltd, epsilon underwriting, and asia mideast insurance and reinsurance pty ltd.

Want a quick quote right away?

Public liability insurance is one of the most common types of insurance for businesses.

While it is not a legal requirement in australia for most businesses, there are some situations where it may be.

One is the legal cost of defending a claim.

If you manufacture products, sell or distribute products or import products into australia, you should have.

Wondering what's public liability insurance & how much it is to take out the cover you need?

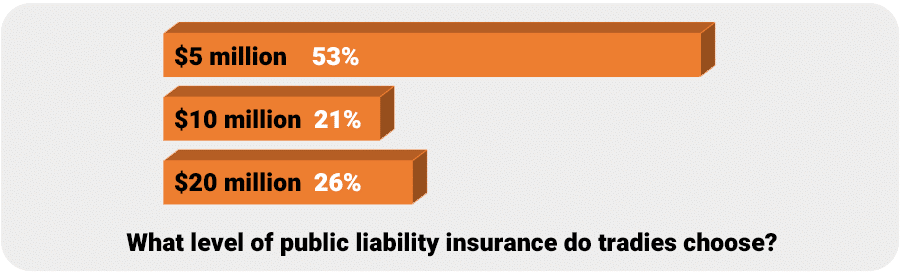

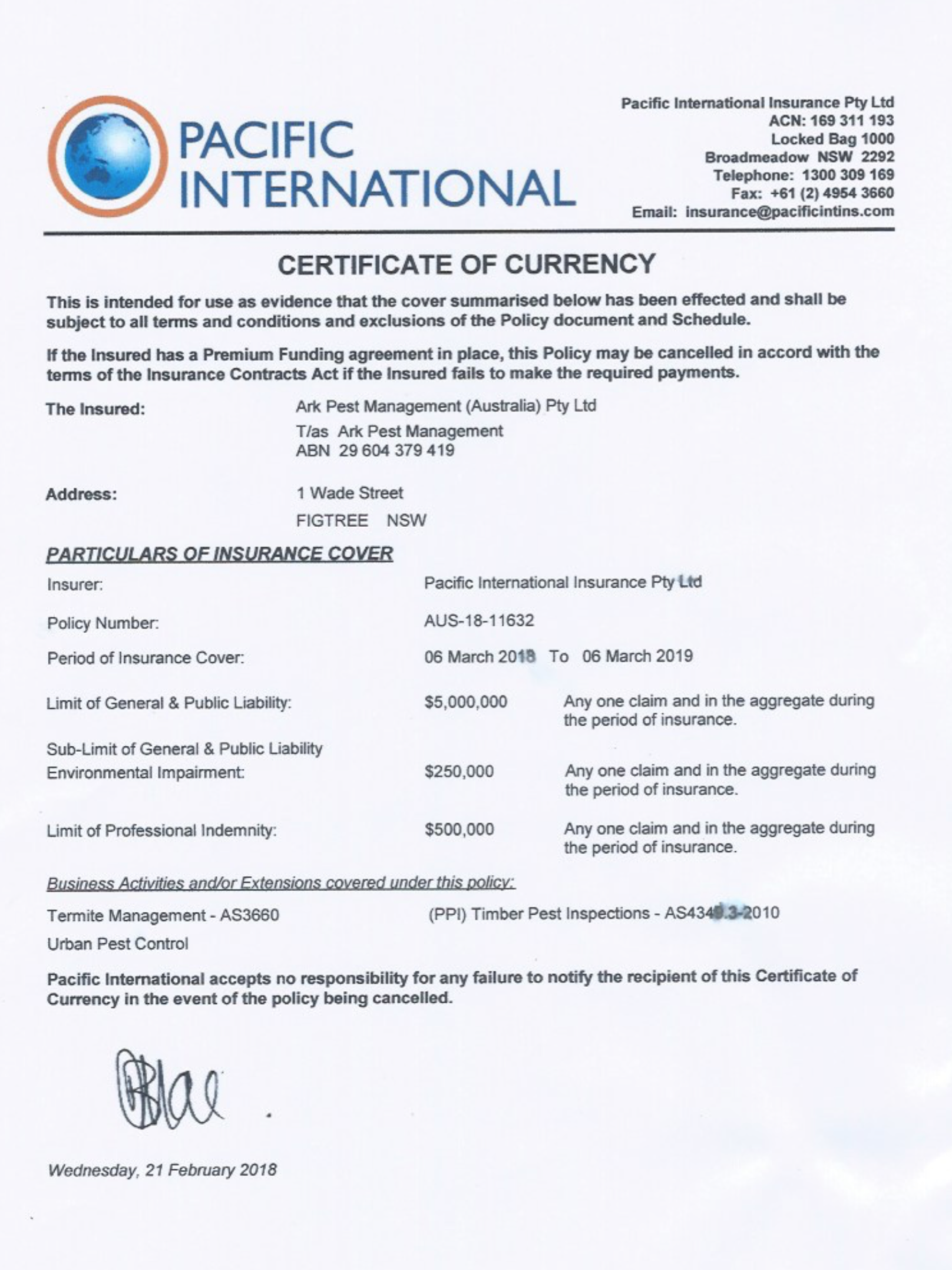

Trades insurance are specialist public liability insurance brokers providing reliable customised insurance policies to tradies across australia.

Your public liability insurance policy is arranged by express insurance acting as an agent of berkley insurance australia, a registered business name of berkley insurance company (abn 53 126 559.

How much will suitable public liability insurance cost your business in australia?

Insurance brokers in australia | compare online insurance quotes.

Australia liability insurance can help one cover his/her liability arising from injuries to or losses australia liability insurance is one of the most popular insurance policies primarily due to its lower.

Note that the product liability is capped per period of insurance, and care needs to be taken if you import goods into australia and you should discuss this with your insurance broker at fully insured.

In addition to public liability insurance we can also assist tradies with a wide range of policy types to.

Compare personal liability benefits from australian travel insurance policies.

Find cover for legal expenses, compensation and damages abroad.

Compare insurance quotes today !

Public liability insurance is your protection if you are found to be legally responsible for personal injury to a third party or damage to their property.

What is public liability insurance*?

Public liability insurance covers an individual or company for personal injury and/or property damage caused to 3rd parties as a result of an occurrence arising out of their business activities.

What is public liability insurance?

In australia, business owners have a duty of care to take reasonable steps for the safety of any third party that comes in contact with their business.

You work in a tough industry.

No matter how careful you are that's why works public liability insurance is the backup you need when you or your workers cause.

Sgic insurance in south australia offers a range of public liability insurance policies.

Ausure horizon offers tailored asbestos liability insurance throughout australia.

Public liability insurance is designed to protect you, your business and your employees against compensation awarded for negligence, for personal injury or property damage, as well the legal costs.

Jam Piket Organ Tubuh (Hati) Bagian 2Cara Baca Tanggal Kadaluarsa Produk Makanan7 Makanan Sebabkan SembelitIni Efek Buruk Overdosis Minum KopiTernyata Inilah HOAX Terbesar Sepanjang MasaIni Manfaat Seledri Bagi Kesehatan3 X Seminggu Makan Ikan, Penyakit Kronis MinggatAsi Lancar Berkat Pepaya Muda4 Manfaat Minum Jus Tomat Sebelum TidurSalah Pilih Sabun, Ini Risikonya!!!Ausure horizon offers tailored asbestos liability insurance throughout australia. Liability Insurance Australia. Public liability insurance is designed to protect you, your business and your employees against compensation awarded for negligence, for personal injury or property damage, as well the legal costs.

How much will suitable public liability insurance cost your business in australia?

Public liability insurance can also cover the cost of.

Public liability insurance can help safeguard your business by providing cover against such claims, including legal defence costs.

With australia having been coined the second most litigious society in the world after the us, the importance of public liability insurance is undeniable.

It's typically required for trade subcontractors to get onto building sites and for commercial lease agreements.

Compare 24 products offered for personal liability insurance from 12 companies including zurich financial services australia ltd, pen underwriting pty ltd, and dual australia pty ltd.

Our personal liability comparison tool allows you to pick the policy that's right for you by comparing every plan.

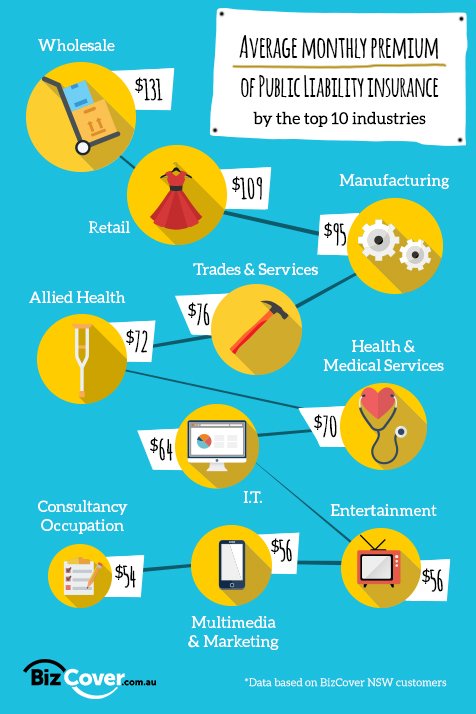

The cost of general liability insurance varies based on your business operations and policy limits, among other factors.

Her public liability insurance steps in to handle the claim and its costs.

There is no overarching statutory requirement in australia for a business to have public liability insurance.

Public liability insurance covers a range of industries and occupations, therefore the cost can vary depending on a number of factors.

Public liability insurance is one of the most popular types of insurance for businesses.

In fact, it is important for almost every kind of business from those that.

Do i need public liability insurance?

Public liability insurance is your protection if you are found to be legally responsible for personal injury public liability can cover the cost of:

Damage to property belonging to a third party.

Trade risk is australia's most awarded trade insurance specialist.

Since 2010 we have assisted over 10,000 tradies with their public liability insurance needs all over australia, and dealt with hundreds of successful claims for our clients.

Luckily, public liability insurance can protect you.

*general insurance in australia report, april 2020.

What would you like to do next?

Public liability insurance could protect your business from some unexpected costs.

Lots of different businesses use public liability insurance to protect against claims of negligence.

For example, if you own a shop and a customer trips on a fallen box and hurts themselves.

What is public liability insurance?

What doesn't it typically cover?

Like all insurance policies, a public liability insurance policy will come with.

Protection against a wide range of risks that come with running a business.

They may not even be your fault.

But they could cost your business millions if you don't have.

General liability insurance costs vary widely based on the type of business being covered.

Four out of 10 small business owners are likely to experience a property or general liability claim in.

Wondering what's public liability insurance & how much it is to take out the cover you need?

It's easy for independent contractors to think of themselves as individuals rather than businesses and assume that they don't need public liability insurance in australia.

One of the easiest ways to look at it is the higher the risk of your business being sued, the higher the cost of your policy.

Get the best id small business insurance quotes online & info on cost, coverage, minimum requirements, certificates & more.

This liability insurance provides coverage that helps protect your small business from claims that come from your normal business operations, such as the cost of general liability insurance is based on your specific business needs.

But, general liability insurance can typically cost $30 a month or less.

Reducing claims is another good way to keep costs of general liability insurance down.

Prioritize safety when people come to your store or office to reduce the possibility of an accident.

Australia liability insurance is one of the most popular insurance policies primarily due to its lower cost as compared to that of comprehensive insurance.

Australia's insurance market can be divided into roughly three components:

Life insurance, general insurance and health insurance.

Management liability insurance is a packaged product made up of several coverage sections customised for directors and officers of private companies.

Product liability insurance cost are about $0.25 (per each $100 in revenue).

Product liability insurance will vary greatly depending on the risk of each type of product.

Basically, liability coverage is a part of your car insurance policy, and helps pay for the other driver's expenses if you cause a car accident.

It does not, however, cover your own.

It's important to note there are two types of liability coverage:

Get affordable travel insurance from a brand you can trust.

Budget overseas holiday cover for unexpected medical costs and personal liability.

Get affordable travel insurance from a brand you can trust. Liability Insurance Australia. Budget overseas holiday cover for unexpected medical costs and personal liability.Fakta Perbedaan Rasa Daging Kambing Dan Domba Dan Cara Pengolahan Yang BenarKhao Neeo, Ketan Mangga Ala ThailandKuliner Legendaris Yang Mulai Langka Di DaerahnyaResep Cream Horn PastrySejarah Nasi Megono Jadi Nasi TentaraTernyata Asal Mula Soto Bukan Menggunakan DagingSejarah Kedelai Menjadi TahuSejarah Prasmanan Alias All You Can EatTernyata Kamu Tidak Tau Makanan Ini Khas Bulan RamadhanTernyata Terang Bulan Berasal Dari Babel

Komentar

Posting Komentar